maricopa county irs tax liens

Ad Get Access to the Largest Online Library of Legal Forms for Any State. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner.

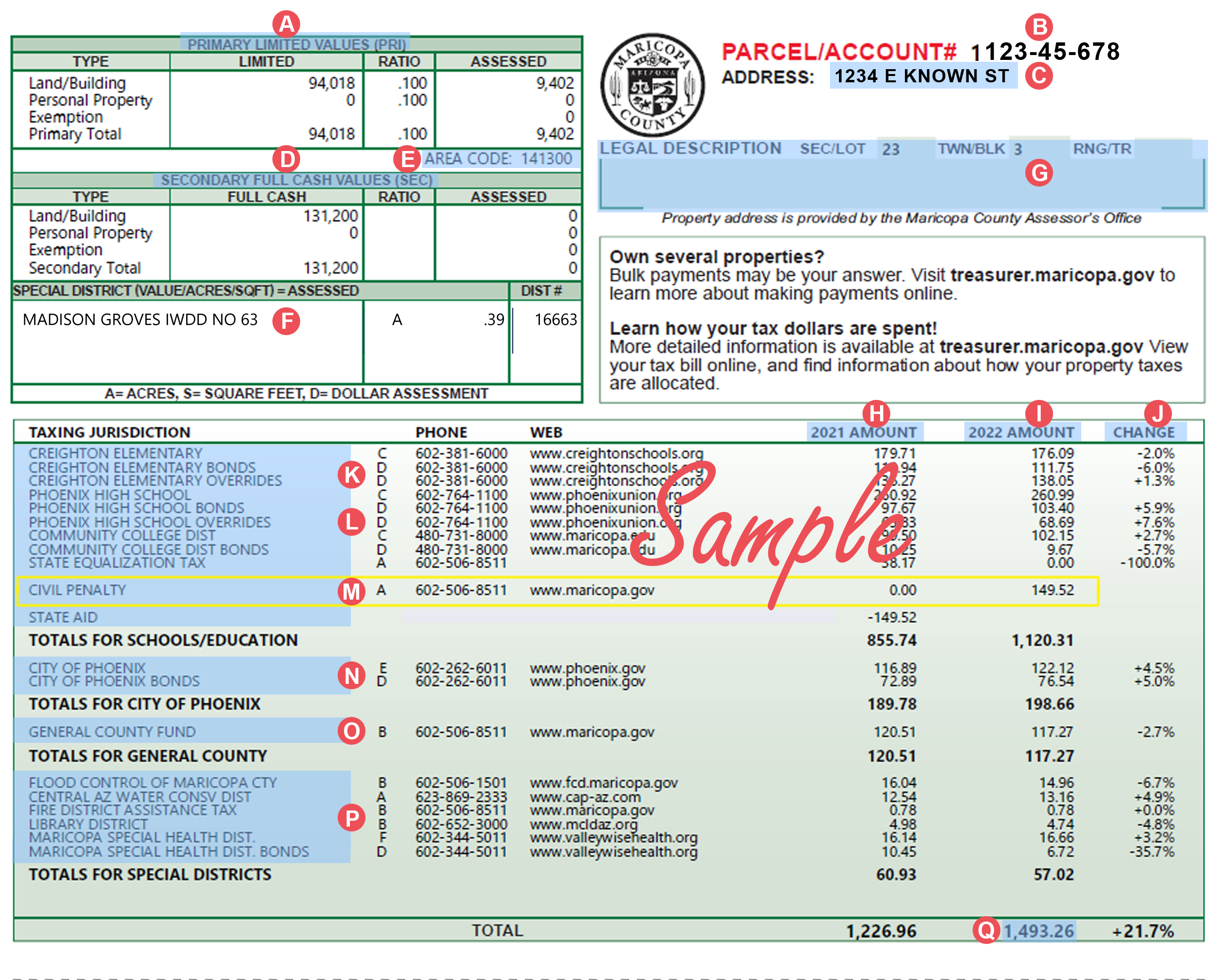

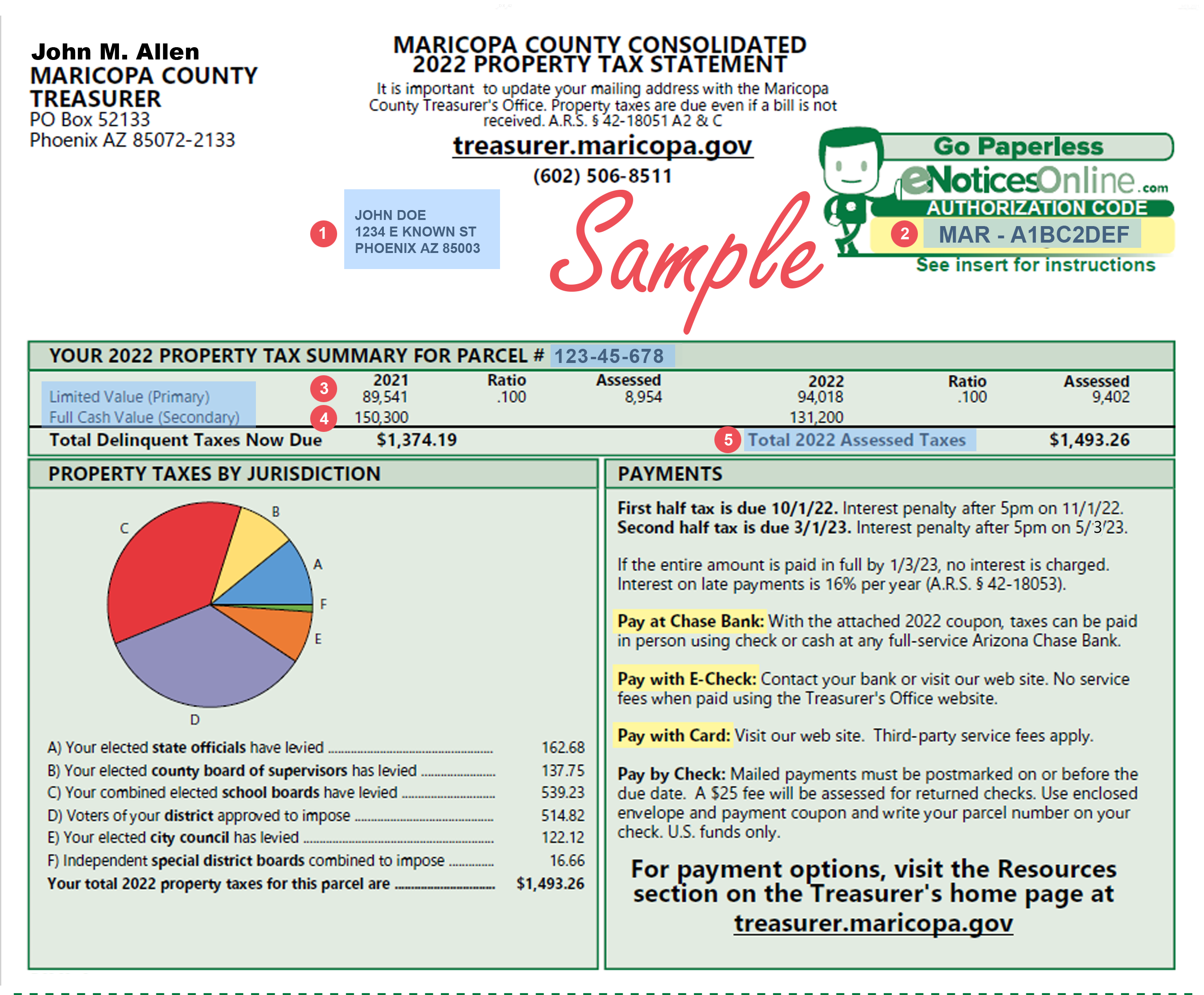

Maricopa County pays up to 16 for tax lien certificates which are sold via a bid down auction.

. Confirmation of lien purchases will be sent by email. Reduce Your Back Taxes With Our Experts. Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered.

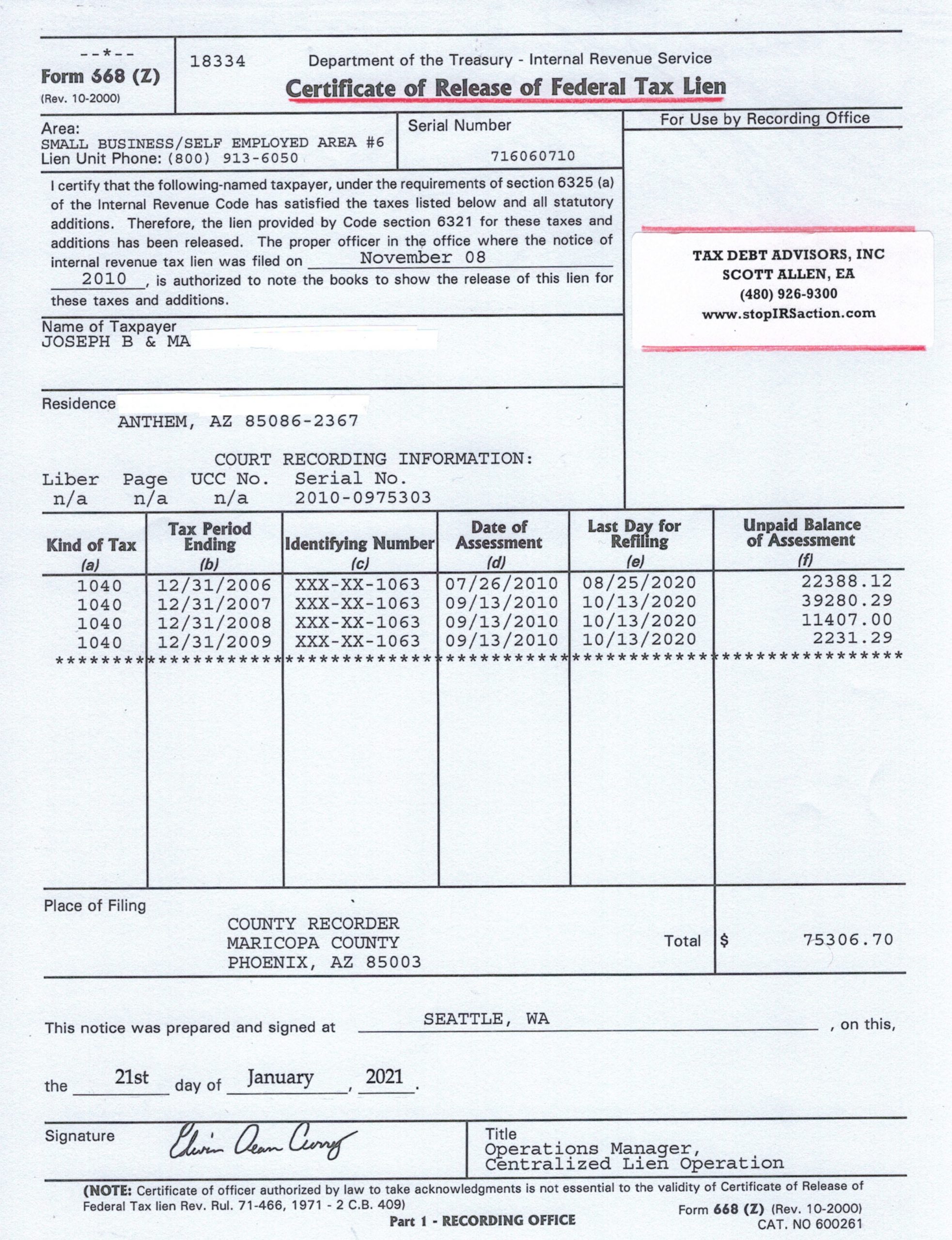

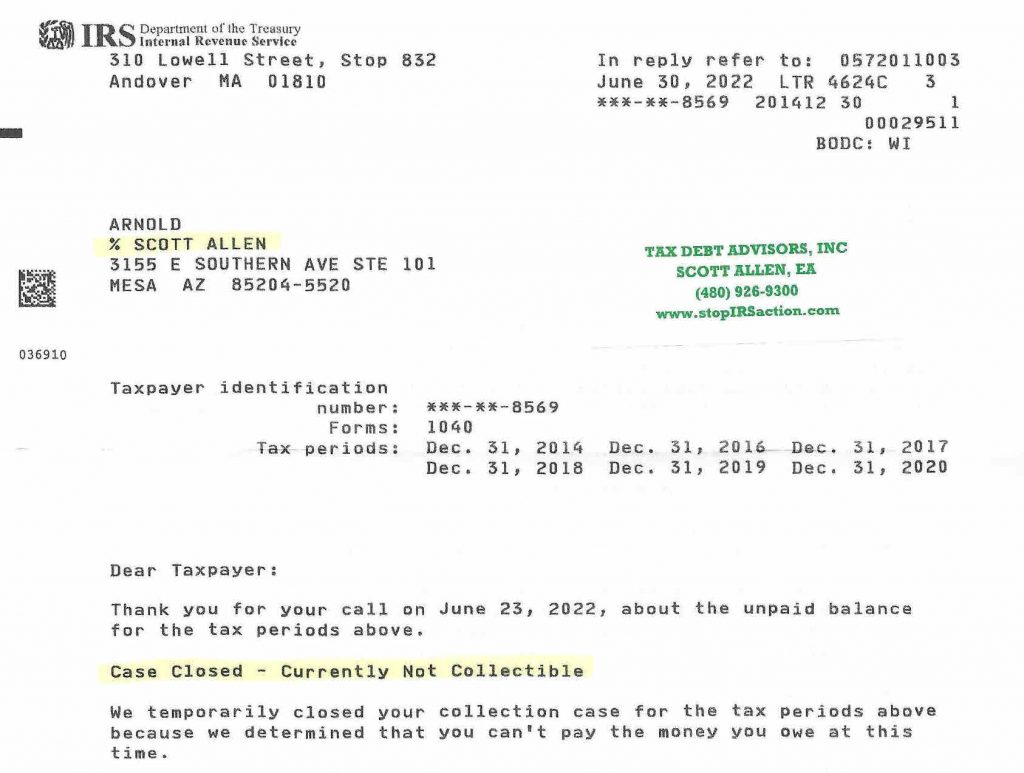

Nonetheless if the federal government does not seek to enforce a tax lien in Maricopa County Arizona within 10 years of imposing it federal law dictates that the lien automatically expires. Tax liens offer many opportunities for you to earn above. Jefferson St Suite 140 Phoenix AZ 85003.

In fact IRS liens priority is based on the order recorded. 95 to 97 of the certificates are redeemed however if you dont get paid you get the. A tax lien in Arizona is a security interest placed on real estate because of unpaid taxes.

Maricopa County Treasurer Attention Tax Lien Department 301 W. Release of State Tax Lien Payment in full with Cash or Certified Funds Upon receipt of a cashiers check or certified funds the Department of Revenue will immediately provide a Notice. Enter Any Address and Find The Information You Need.

The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map. You May Qualify for an IRS Forgiveness Program. In fact the rate of return on property tax liens investments.

End Your Tax Nightmare Now. Ad Owe the IRS. Many people think that IRS liens have higher priority.

Maricopa County AZ currently has 18201 tax liens available as of September 11. Ad Looking for Maricopa Lien Records. Based On Circumstances You May Already Qualify For Tax Relief.

This makes tax lien investing very safe. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate.

All groups and messages. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Ad See If You Qualify For IRS Fresh Start Program.

Free Case Review Begin Online. Tax liens are involuntary and general because they are placed mainly on real or personal. Visit Our Official Website Today.

Tax Department The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or. The interest rate paid.

The Essential List Of Tax Lien Certificate States

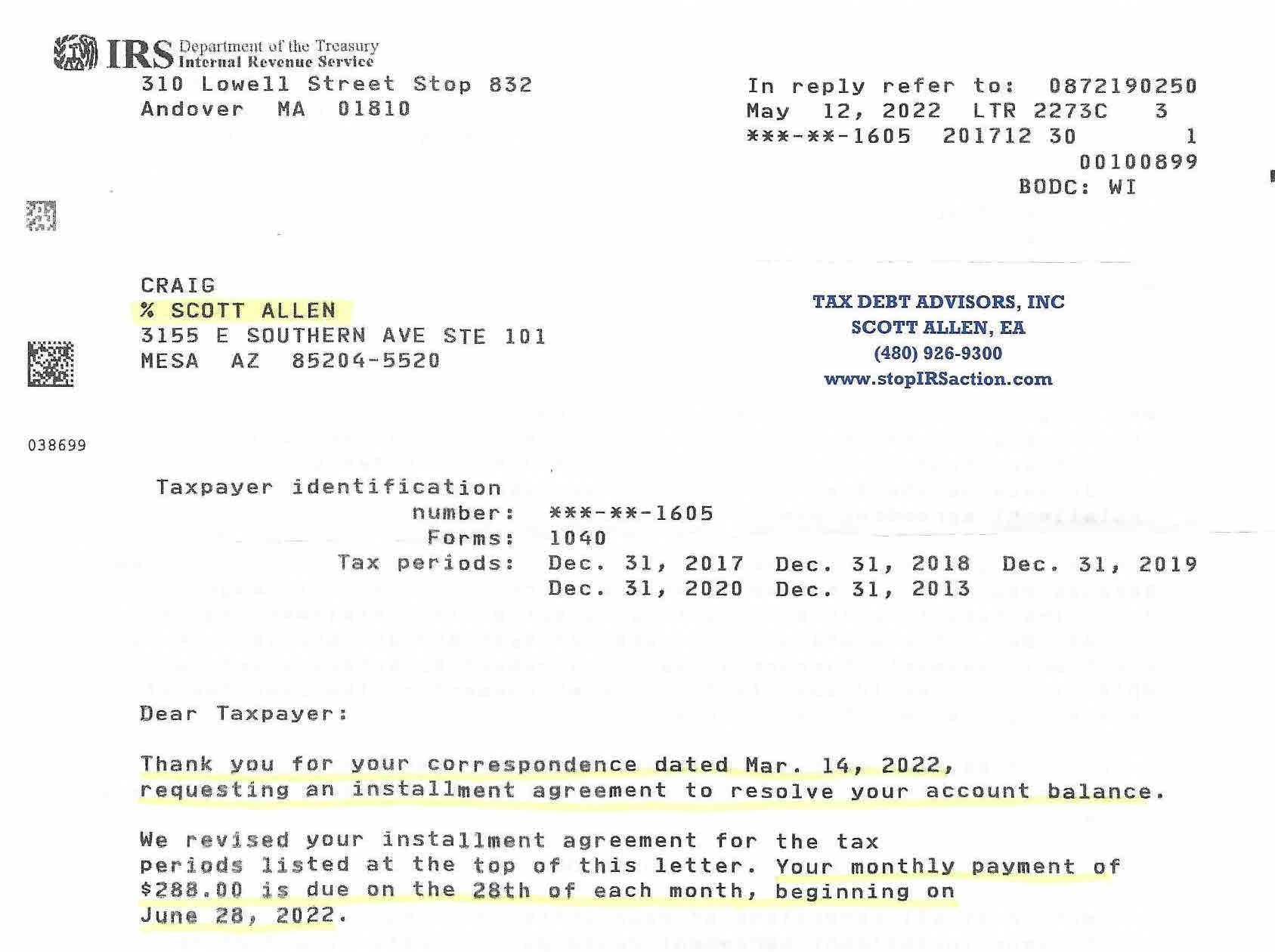

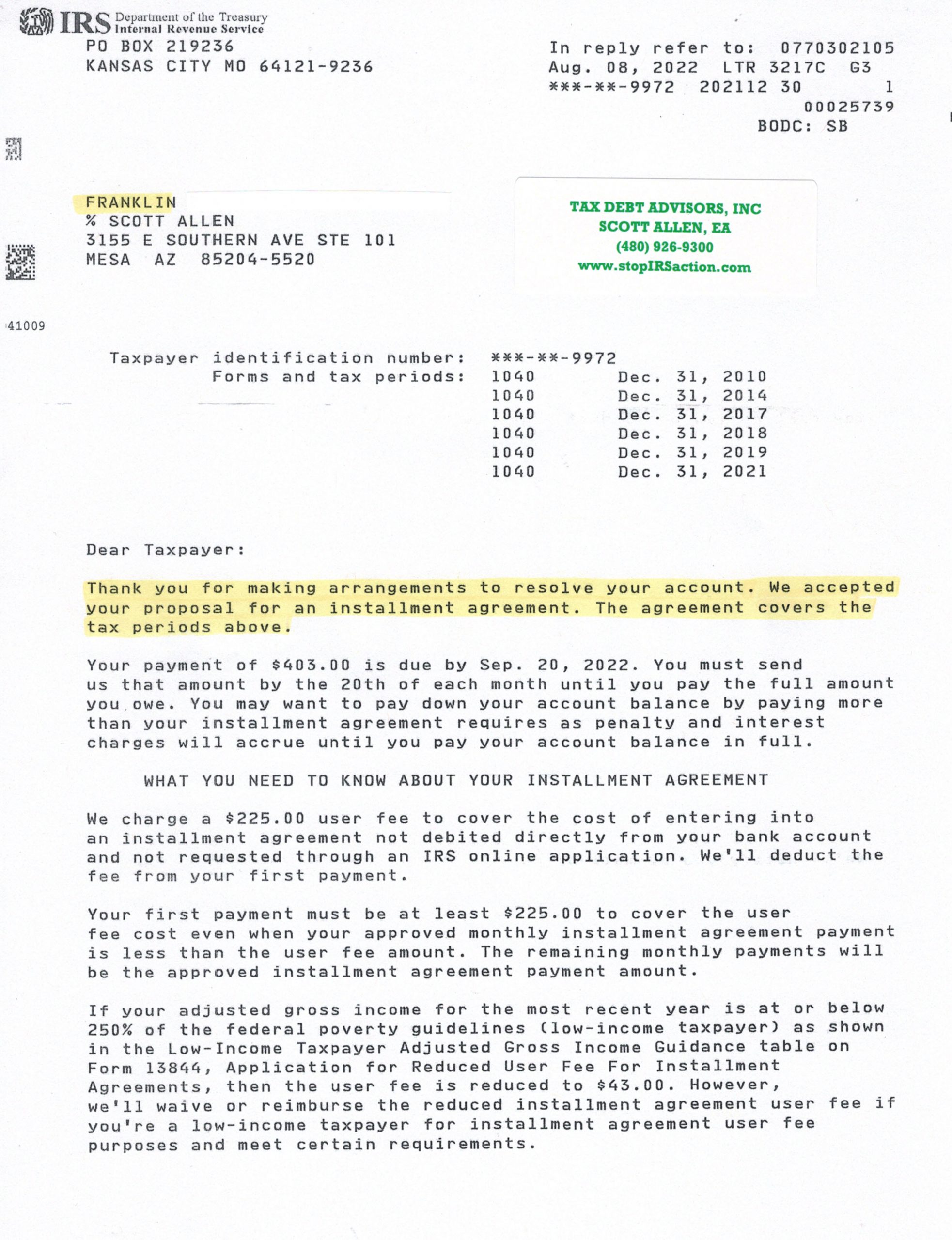

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Irs Tax Lien Problems Tax Debt Advisors

Social Security Is There Really A 16 728 Bonus Marca

The Essential List Of Tax Lien Certificate States

Irs Tax Lien Problems Tax Debt Advisors

Irs Tax Attorney Tax Debt Advisors

Pin By Sun City Home Owners Associati On Schoa Sun City Arizona House Styles Mansions

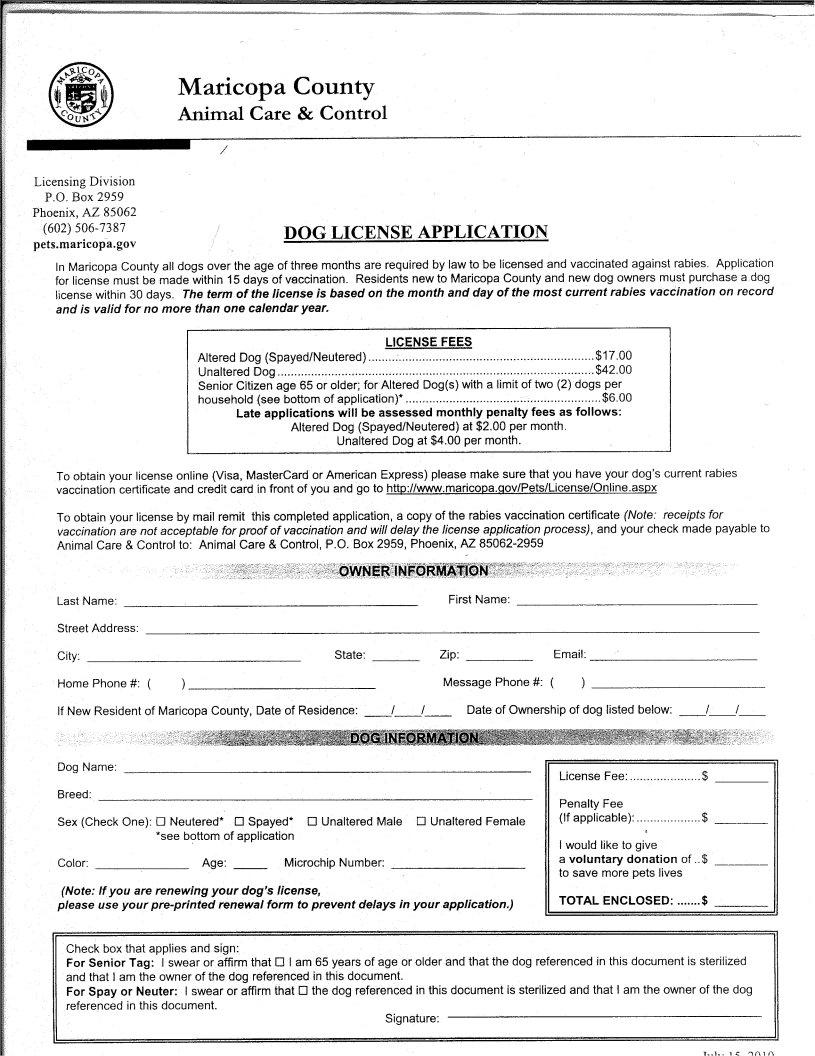

Dog License Maricopa Fill Out Printable Pdf Forms Online

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

The Basics Of Tax Liens Arizona School Of Real Estate And Business

The Essential List Of Tax Lien Certificate States